-

Section 01

Overview

-

Section 02

Ngā hononga, me ngā tūranga, me ngā haepapa Relationships, roles and responsibilities

-

Section 03

Te kopou me te tuarā i tētahi poari hurikiko Appointing and maintaining an effective board

-

Section 04

Te whāi wāhi atu ki te whakatakoto i ngā kawatau me te ara whakamua mō ngā hinonga Participating in setting the expectations and direction for entities

-

Section 05

Ka pēhea tā tō tari aroturuki āwhina i a koe? How can your monitoring department assist you?

-

Section 06

Appendices

Regular engagement with boards

Key messages:

Setting strategic direction and annual expectations

As the responsible minister, you “participate in the process of setting and monitoring the entityʼs strategic direction and targets” (s. 27 of the CEA). This is an important way for you to influence the performance of Crown entities. There are various ways you can engage with an entity to achieve this – for instance, by a letter of expectations, through the annual Statement of Performance Expectations (SPE) process, and through the development and review of an entityʼs Statement of Intent (SOI). Many ministers meet regularly with chairs and boards, especially when they are engaged in strategic planning and preparation of the annual business plan.

As the responsible minister, you should regularly engage with your board(s) to clarify performance and any other expectations you or the Government may have, reduce misunderstandings, and enhance the relationship you have with the board. When involved in strategic conversations with Crown entities, you should make sure the entityʼs proposed direction:

- adequately reflects the Crownʼs interests and priorities, including the results across a sector

- presents an acceptable balance between opportunities and risks

- is achievable by the Crown entity and its board.

You should engage with the entity on issues that relate to its performance, in particular:

- the activities/projects that were undertaken in the past year

- the intentions of the entity for the coming year and next three years

- any changes being made to its operating environment

- the financial implications of the entityʼs future work programme, and

- what reporting you require and how performance should be reported.

You must also consider whether the proposed strategic direction needs:

- any change to the statutory and policy framework under which the Crown entity operates

- a new SOI

- regular reporting to ensure you receive the performance information you require

- a review of the entityʼs performance and operation

- either a ministerial direction or a direction to support a whole of government approach (if applicable to three or more entities).

You may choose methods of engagement with the entity as best fits your relationship with the particular board. For example, you may choose to discuss the direction and expectations for the next year in a meeting with the chair/entire board and/or may decide to send a written document in the form of a letter of expectations. Such a letter would usually be sent to the chair before the board starts its strategic planning for the coming year. Your monitoring department can help with this.

Statement of Intent

Key messages:

Purpose of the SOI

The Statement of Intent (SOI) is a key opportunity for the minister to influence the medium-term strategic direction of the entity. The SOI is an enduring document with a four-year focus that must be updated at least once every three years. The annual review of an entityʼs strategy may result in the SOI being amended or a new one produced. There is provision in the CEA for the minister to ask for a new SOI at any time.

You can participate in setting an entityʼs medium-term direction through the entityʼs annual strategic planning process. Together with the monitoring department, you need to engage with an entity before it starts its annual review. The annual review can result in the SOI being re- confirmed as fit for purpose, amended or replaced.

You have the opportunity to review and provide comment on a draft SOI and, in the case of a newly established entity, to direct that changes occur before it's finalised. The SOI for a Crown entity is prepared by the entity and signed off by the entityʼs board.42 You can direct amendments to a final SOI, excluding the entityʼs explanation of how it intends to manage its organisational health and capability.

Your monitoring department should be engaging with the entity as it develops its strategic intentions, and advise you on whether an entityʼs draft SOI adequately covers matters such as:

- whether the entity has met the legislative requirements for the SOI?

- is the strategy sustainable?

- how well is the entity strategy articulated and is it responding to your priorities?

- whether the entityʼs strategic planning helps advance stewardship and the long-term public interest including services to New Zealanders and outcomes for New Zealand?

- an analysis of the relationships with stakeholders and how the entity will work with other agencies

- review of financial risks to the Crown

- the effectiveness of the strategic review process, and

- which areas the monitor intends to focus on in the coming year.

Statement of Performance Expectations

Key messages:

Purpose of the SPE

The Statement of Performance Expectations (SPE) is a key instrument of public accountability and enables the Crown to participate in setting annual expectations for outputs directly funded by appropriations, levies or by compulsory fees or charges set under legislation. It also serves to set out those intentions for the House of Representatives, provides a base against which the entityʼs actual performance can be assessed, and includes the entityʼs financial forecasts for the next year. The SPE results from the entityʼs annual business review and planning processes.

When you participate in the annual strategic planning process you can also set annual performance expectations which are to be reflected in the SPE. Your monitoring department43 should advise you on whether an entityʼs SPE adequately covers matters such as:

- its fit with the agreed strategy

- how well is the entity delivering on its core functions

- its consistency with government policy and any directions (to the extent applicable to the entity concerned)

- whether the level of funding (from appropriations, levies etc) should be adjusted

- what is intended to be achieved with the expenditure

- how performance will be assessed

- whether the SPE would be useful as a standalone document or presented with other accountability documents, and

- whether the performance information tells a meaningful performance story.

You have the right to review and provide comment on the draft SPE and, if the final SPE is not adequate, you may direct the Crown entity to make changes.44 Although an SPE must be tabled each year, there may be no need to completely rewrite it. Minimal changes may be made, with your agreement, if there is no substantial shift in the entityʼs activities from the previous year.

In some circumstances, while not provided for in legislation, you may request the entity prepare a memorandum of understanding, relationship agreement, or similar document to assist you, the monitor and the entity to clarify, align, and manage expectations and responsibilities.

Publishing and presenting SPEs and SOIs

Publishing – Crown entities must publish the SPE or SOI (and any amendments to either document) on their website once the final document has been provided to you as responsible minister, unless you have required that publication be delayed during the pre-Budget period.

Presenting to the House – The responsible minister has an obligation to present the SOI and SPE to the House. There are various options for when and how they are presented to Parliament and which minister presents them. For example, the SOI and SPE could be presented as separate documents, combined documents, with the annual report, or within a sectoral report. Presenting the documents together has the advantage of providing the Parliament with a backwards and forwards-looking story. Your monitoring department can advise you on this.

Ensuring financially responsible management

Crown entities are required to ʻoperate in a financially responsible mannerʼ.45 They must:

- manage their assets and liabilities prudently

- endeavour to ensure their long-term viability

- endeavour to ensure it acts as a successful going46

This requires that:

- the board maintain oversight of the entity and its cost drivers, and re-prioritise activities to make the most of the expenditure available without going into deficit

- any application to adjust statutory fees or levies is made early enough to be completed in time for the adjustment to apply from the intended date

- any requests for additional operating funding or a capital injection from the Crown are fully specified, clear about trade-offs, and submitted as per the Budget timetable.

To help ensure all Crown entity funding issues are appropriately managed, you can ask the monitoring department to:

- advise on the efficiency and effectiveness of Crown entity spending

- critically assess proposals for new money or adjustment to fees and levies

- distribute Budget-round information to Crown entities (timetables, templates, Budget decisions that relate specifically to the entity, ) and rank bids for additional funding against other bids from the sector, and

- ensure funding decisions are reflected in accountability

As the responsible minister, you may be involved in an examination of the Estimates. The Estimates are the governmentʼs request for appropriations/authorisation for the allocation of resources and are tabled on Budget day. Crown entities do not attend Select Committees when they examine the Estimates, but you and the monitoring department may be questioned about the intended activities and expenditure of an entity that receives funding from appropriations.

Transparency of reporting

You should encourage the board to publish performance information on its website. The publication of performance information enables greater transparency and supports performance improvement through public monitoring of the entityʼs performance.47

Crown entities, like their private sector counterparts, are only expected to report at the consolidated group level rather than separately disclosing information about the parent and its subsidiaries. The minister of Finance, however, has the power48 to require additional reporting from any member of the group (i.e. the parent or the subsidiary) where it's necessary or desirable to enhance public accountability of the individual member of the group.49

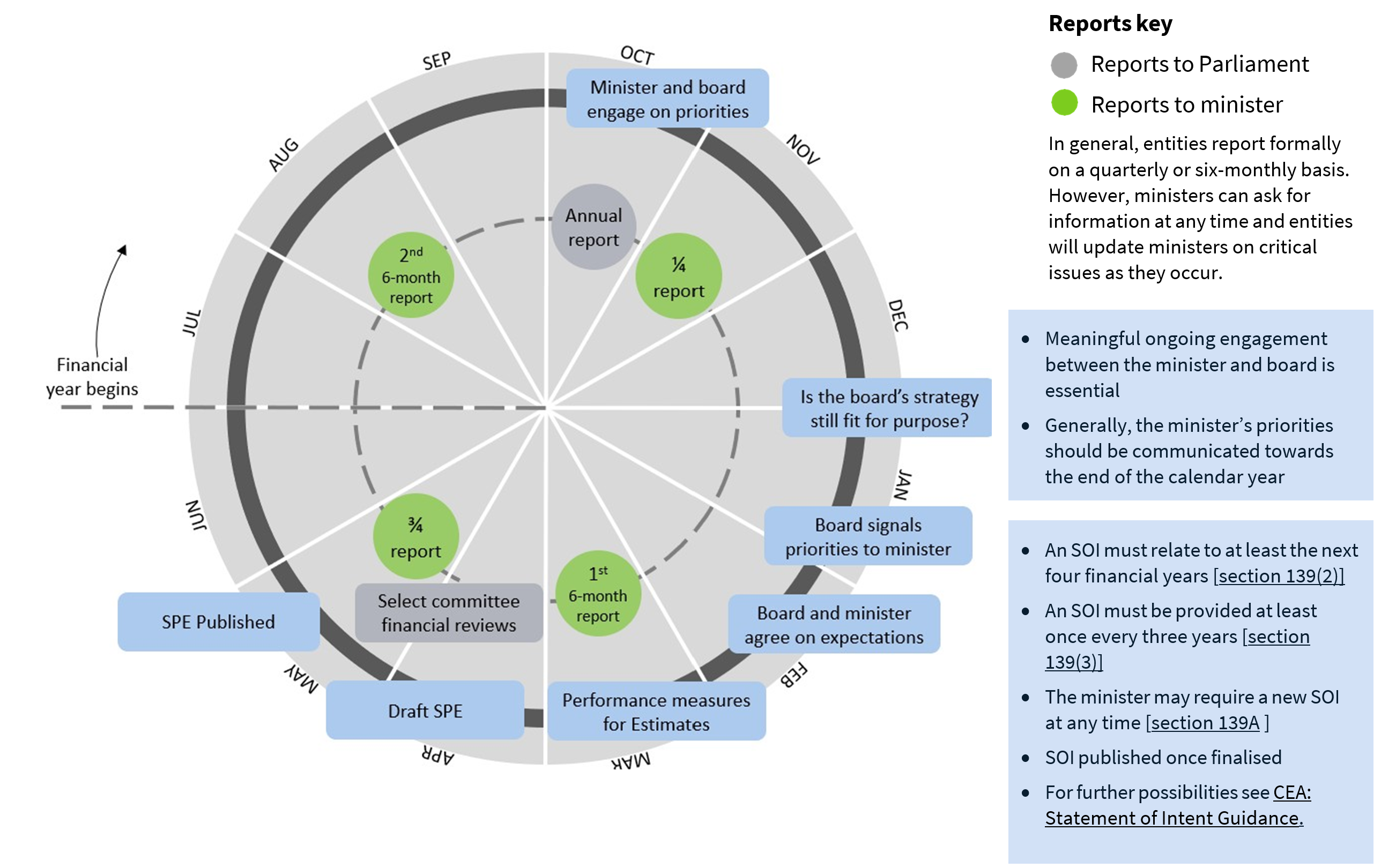

Typical planning, implementation, monitoring and reporting cycle

The diagram below sets the planning, implementation, monitoring and reporting cycle. The planning cycle starts with a strategy development phase, usually from October on, during which the minister and board engage on priorities. The SOI can be amended or replaced at any time if required. However, the SPE timetable is clearly prescribed in legislation, and follows a regular annual pattern.

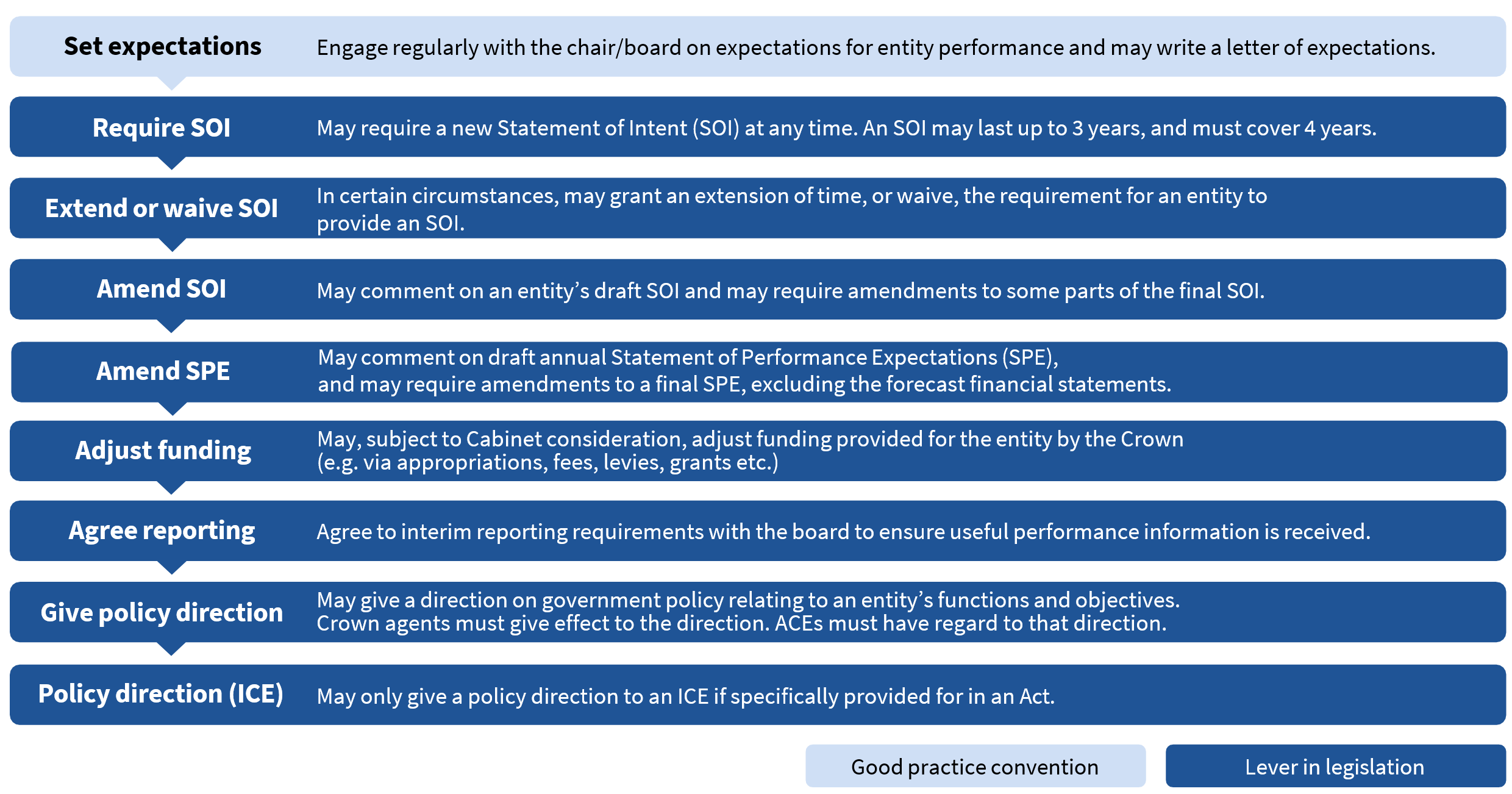

Summary of levers for setting strategic direction

In summary, key levers that the responsible minister can use in the directions-setting process are shown below.

Figure 4: The responsible minister’s levers for setting strategic direction

42In certain limited circumstances (e.g. establishment or disestablishment of an entity) you may grant an extension of time or waive the requirement for an SOI.

43The Treasury has a suite of guidance to help departments and entities with planning and reporting. See Performance Expectations - 'What Is Intended to Be Achieved'.

44Direction may be given on issues of scope (of an SOI), statements of forecast service performance, performance measures and other issues. However the CEA prevents from ministers giving directions on the forecast financial statements or that affect statutorily independent functions. Ministers should seek legal advice before a direction is issued.

45Section 51 of the CEA applies the requirement for financial responsibility to statutory entities.

46A ʻgoing concernʼ is a business or entity that continues to exist long enough to carry out its objectives and commitments without the threat of liquidation for the foreseeable future.

47For example, DHB results are reported regularly (monthly or six-weekly) through public meetings of their board. This information (operational and financial results) is publicly available through this forum and via the DHBsʼ websites.

48Refer CEA s.133.

49Particular rules apply to multi-parent subsidiaries. If applicable see: Preparing the Annual Report and End-of-Year Performance Information on Appropriations: Guidance for Crown Entities for more details.